Understanding Commissions in Everyday Transactions

In our daily lives, we frequently encounter various types of fees and commissions. From credit card transaction fees in retail stores to brokerage commissions for stock trades, these costs are a common part of many financial transactions. Similarly, in real estate, commissions play a significant role, especially given the higher value of property transactions.

Real Estate Commissions: Breaking Down the Costs

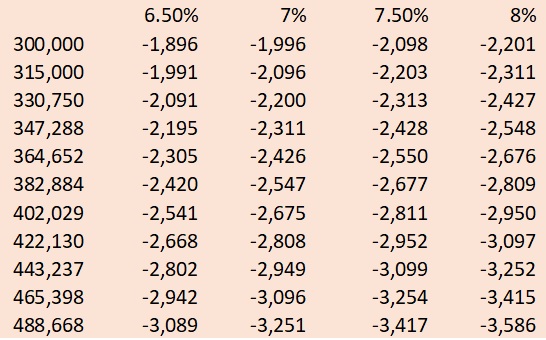

When a house is put up for sale, there are typically two sides involved: the seller and the buyer. The commission, usually set by the seller’s agent, is often a percentage of the sale price. This commission is then shared between the seller’s agent and the buyer’s agent. It’s a common misconception that only the seller should bear this cost. However, if buyers were solely responsible for their agent’s commission, it could significantly hinder their ability to purchase a home, as these costs would be additional to the down payment and not covered by mortgage loans.

The Reality of Agent Commissions

Let’s delve into the specifics of how commissions are distributed. For instance, on a $500,000 home sale with a 5% commission, the total commission is $25,000, split between the seller’s and buyer’s agents. However, this amount is not the final take-home for the agent. Referral fees (often around 40%), brokerage fees, and other expenses like self-employment taxes, MLS dues, and marketing costs significantly reduce the net income from the commission.

The Misconception of High Earnings in Real Estate

Many people believe that real estate agents make a substantial income from each transaction. However, the reality is quite different. The average agent conducts around four transactions per year. After accounting for all the expenses and taxes, the net income is often much lower than expected. In markets like Hillsborough County, with more agents than available properties, many agents end up with no transactions at all.

The Value of Professional Real Estate Services

While some homeowners consider saving on commissions by opting for a ‘For Sale By Owner’ approach, it’s important to recognize the value of professional services. Real estate agents, through their experience and expertise, navigate the complexities of property transactions, legal aspects, and market trends. Paying a commission is not just for transaction facilitation but also for the professional advice and experience that agents bring to the table.

Conclusion: A Balanced Perspective on Commissions

Understanding the structure and reality of real estate commissions is crucial for both buyers and sellers. It’s not just about the percentage paid but also about the value and expertise that a professional agent brings to your real estate journey. As with any service, you often get what you pay for, and in real estate, this means securing the best possible outcome for your property transaction.

For more insights and assistance, feel free to reach out at Joe Brownc21.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

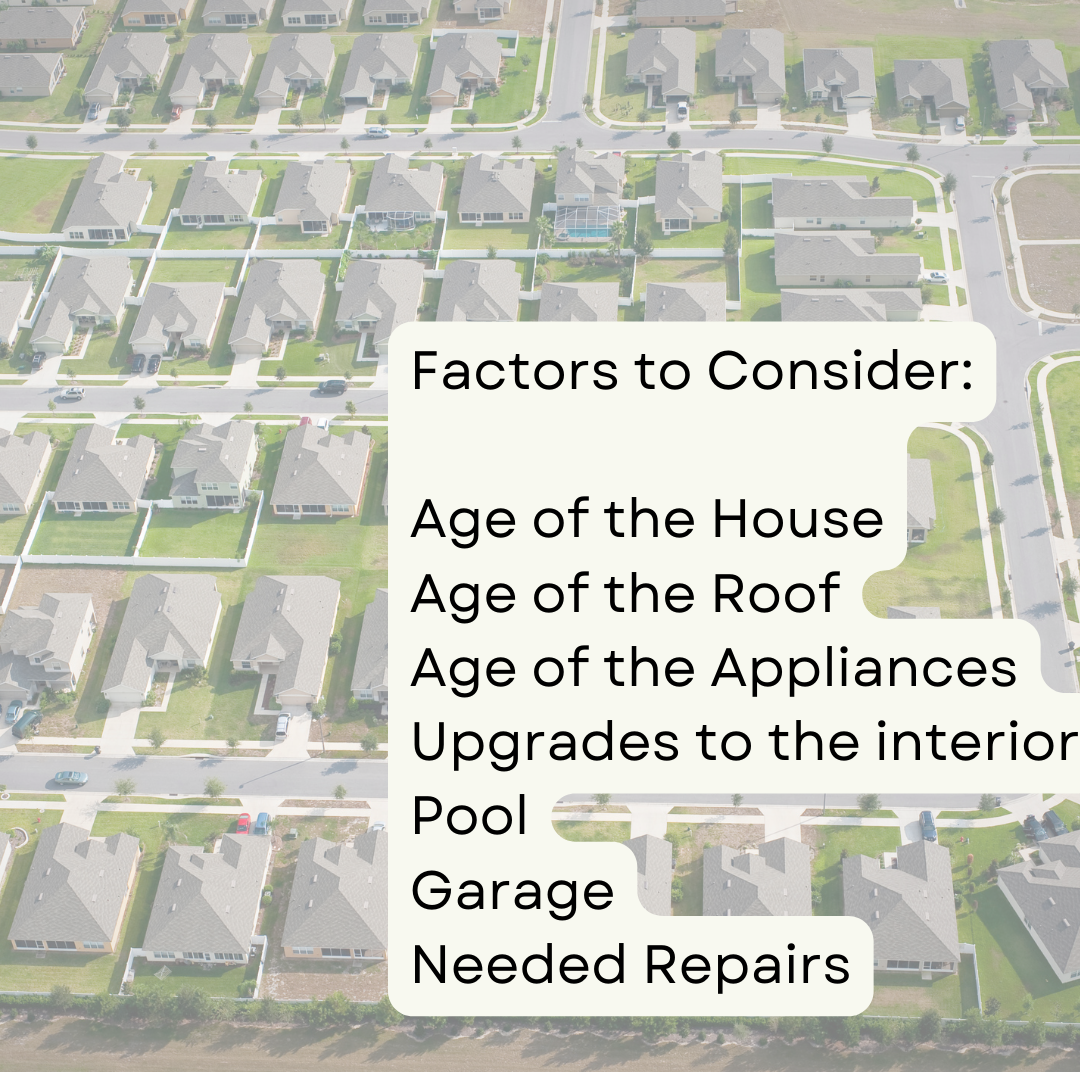

Getting Pre-Approved for a Mortgage: Getting pre-approved for a mortgage can help you set a budget and narrow down your search. Several lenders offer different rates, so make sure to compare them and get the best deal. A pre-approval can also increase your bargaining power during negotiations with the seller. Negotiating with the Seller: Negotiation is one of the most crucial steps in buying a house. By being proactive, you can negotiate the price, closing costs, and other expenses. Look for areas where you can cut costs, be it the repairs or the closing costs. Remember, the negotiations shouldn’t get confrontational, so maintain a congenial relationship with the seller. Working with a Real Estate Agent: A real estate agent can assist you throughout the entire buying process. They can help you find affordable properties and negotiate with the seller. The agent can also connect you with lenders, inspectors, and contractors. Opt for an experienced agent who understands your budget and can provide personalized advice. Remember, buying a house is a big decision, and it’s okay to take it slow. Don’t feel pressured to purchase a property just because the market is hot. Aiming for a property within or slightly lower than your budget range can give you a cushion for the future. With the right strategies, you can purchase a beautiful home and save some bucks for rainy days.

Getting Pre-Approved for a Mortgage: Getting pre-approved for a mortgage can help you set a budget and narrow down your search. Several lenders offer different rates, so make sure to compare them and get the best deal. A pre-approval can also increase your bargaining power during negotiations with the seller. Negotiating with the Seller: Negotiation is one of the most crucial steps in buying a house. By being proactive, you can negotiate the price, closing costs, and other expenses. Look for areas where you can cut costs, be it the repairs or the closing costs. Remember, the negotiations shouldn’t get confrontational, so maintain a congenial relationship with the seller. Working with a Real Estate Agent: A real estate agent can assist you throughout the entire buying process. They can help you find affordable properties and negotiate with the seller. The agent can also connect you with lenders, inspectors, and contractors. Opt for an experienced agent who understands your budget and can provide personalized advice. Remember, buying a house is a big decision, and it’s okay to take it slow. Don’t feel pressured to purchase a property just because the market is hot. Aiming for a property within or slightly lower than your budget range can give you a cushion for the future. With the right strategies, you can purchase a beautiful home and save some bucks for rainy days.