There are many factors impacting the housing market right now. Inflation is still higher than the Fed wants, so interest rates continue to rise, which causes the 10-year treasury yield to increase which moves mortgage rates higher. Coupled with these factors is the fact that inventory is very low. We are still in a seller’s market with three months of inventory on the market.

Currently, the 30-year prime mortgage rate is 7.63. This is the highest rate in 23 years. Buyers have said they will wait until mortgage rates come down. That thinking is understandable however, buyers may find it may not matter.

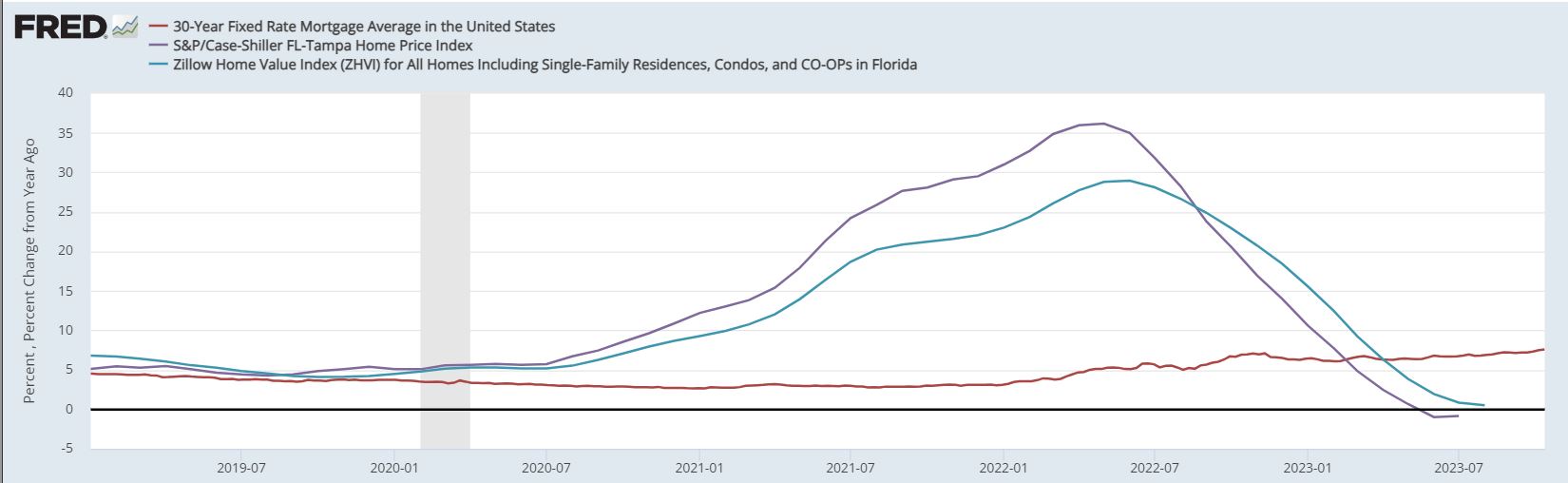

Below is a graph showing mortgage rates (the red line) and the year-over-year change in home prices.

The right side of the graph does not show that home prices are falling only that the year-over-year change has moved to zero. As an example, let’s say a family bought a house for $300,000. In the mid-2020s home prices increased 30%. That home is now worth $390,000. With the change in home prices nearing zero, that means the house is still worth $390,000.

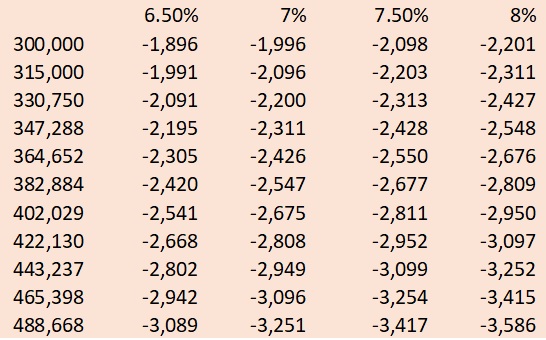

As mortgage rates move down, more buyers will be willing to act and purchase a house. This will drive demand and thus drive home prices up. It is a classic example of supply and demand. The chart below gives an example of what a buyer would be expected to pay at different mortgage rates.

You can see the chart has an 8% mortgage rate. The prime rate may get there soon, but the reality is that buyers are already paying over 9%, depending on their credit score.

If a buyer has a mortgage rate of 8% for a $300,000 loan, they expect to pay about $2200 a month. If the mortgage rates drop, buyer demand will increase, and assume home values increase by 5%. The buyer can now get a $315,000 loan at a 7.5% mortgage and pay about $2200 a month. If rates go down to 7% and home values increase 5% again, the buyer can get a loan of $330,000 at 7% mortgage and pay about $2200 a month. In this scenario, the buyer did not gain anything by waiting.

The ideal situation for a buyer is that mortgage rates decrease, and home prices stay the same. That scenario is not likely to happen due to the low supply of homes on the market.

There is a popular saying that you marry the house and date the mortgage. If there is a house you really like, and can afford, buy the house now. If mortgage rates drop in the future, you can refinance and lower your monthly payment.

People have gotten used to the low mortgage rate environment that has been in place for the past ten years. During the COVID recovery phase, interest rates were at zero and mortgage rates were around 3%. That situation is an anomaly that should not repeat itself, save for a tragic situation. Indications are that mortgage rates will remain elevated through 2024. Rates may stabilize in the mid-6% range.

Should you buy a house now or wait? The answer depends on two key questions. Is there a house you really like? Can you afford that house now? If the answer to both of these questions is yes, then buy the house now.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link