There are times in life when having a crystal ball would really make life easier. Like when Powerball was over $1 billion. So, without a crystal ball, we look at the signs of the times and make the best guess.

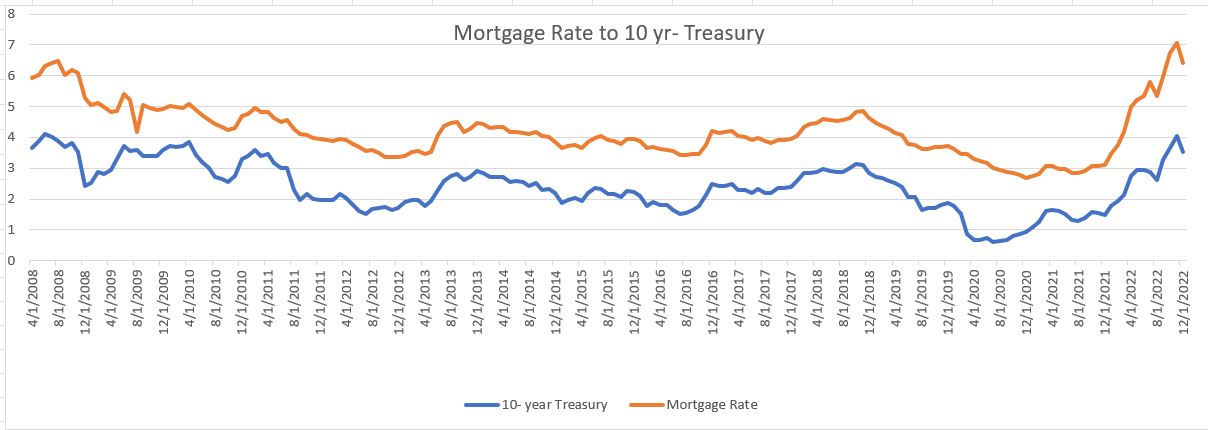

The most important factor that will either inspire or depress the real estate market is the mortgage rate. Mortgage rates track the 10-year Treasury Bond, as can be seen in the graphic below.

The 10-year Treasury is impacted by the interest rate which is set by the Federal Reserve. This rate is now at 4.5%.

At the December 2022 Fed meeting, Chairman Powell said that he sees several more rate hikes occurring this year. A few members of the Federal Reserve Board suggest that the rate needs to get to 5.5%. If this happens, I think we could see mortgage rates above 7.5%, even close to 8%.

However, I have also read reports from economists who believe that the rates will begin coming down, even to a point of 5.5% at the end of the year.

A second major point to consider is the supply of homes on the market. At the end of December, we currently have three months of inventory on the market. This is still a seller’s market and home prices could still increase.

Consider the see-saw. As one side goes up, the other goes down. Now, put mortgage rates on one side and home prices on the other. If buyers are waiting for home prices to come down, chances are that mortgage rates will be higher. If buyers are waiting for mortgage rates to come down, then home prices will be higher. At the end of the day, the monthly budget is about the same on a monthly basis. This can be seen in the chart below.

| Loan Amount | Mortgage Rate | Monthly Principal and Interest |

| 350,000 | 6.0 | 2098.43 |

| 335,000 | 6.5 | 2117.43 |

| 320,000 | 7.0 | 2128.97 |

As shown above, you would actually pay more per month for a home priced at $30,000 less.

Another factor to consider is the cost of renting. While home prices to expected to increase less than 1% this year, rent is expected to increase, though rents have come down in some areas. Renters are feeling the squeeze. And, unfortunately, rising rents mean that renters have less money to save for a down payment for a home.

What’s my advice: If you are in a position to buy a house, buy now. If rates do come down, then you can refinance. If home prices come down, you may pay more each month, as shown above.

There is also a loan program available that will allow buyers to buy a home that needs work (usually these homes are priced lower) and will loan the money for the work to be done. So, you could buy a move-in ready house for $350,000. Or, you could buy a house in need of repair for $300,000 and get $50,000 for renovations. By the way, these figures were off the top of my head and not actual examples.

Contact me if you have questions about these renovation loans. I can put you in contact with an expert who has done renovation loans for over 15 years.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link