What will the real estate market be like in 2023?

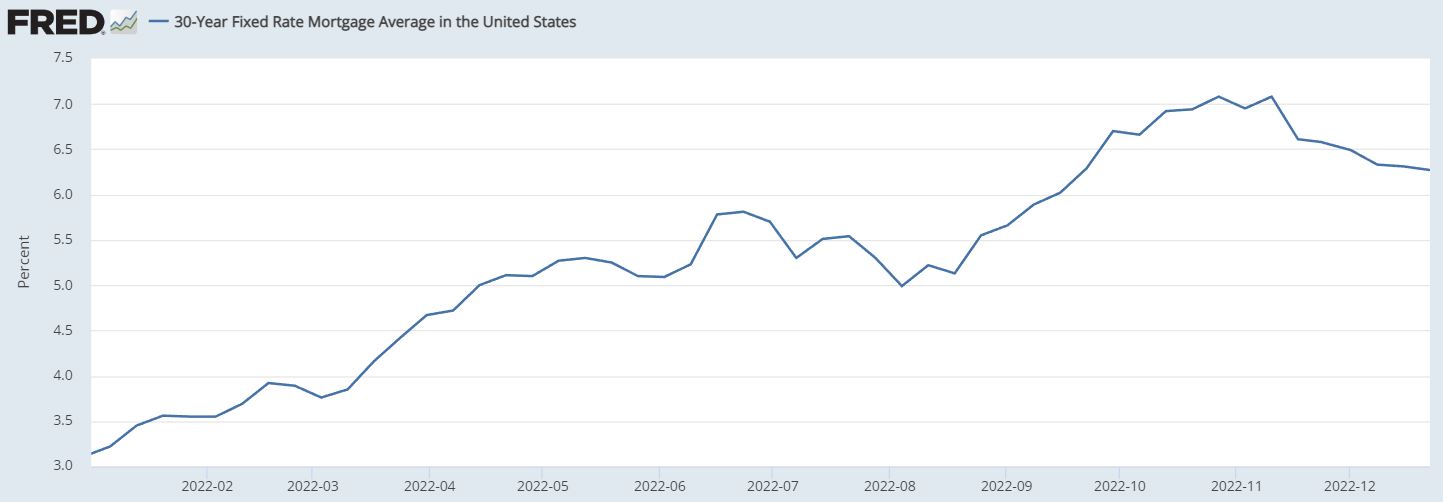

The key to the 2023 real estate market will be mortgage rates. Graphic 1 shows the rise of mortgage rates over 2022.

Graphic 1: Mortgage rates for 2022

The rise in mortgage rates has dramatically impacted buyers’ affordability. For example, if a family could afford $2400 a month for principal and interest, in January (when rates were 3.2%) they could have obtained a loan for $555,000. However, when the mortgage rate hit 7% in September, this same family could get a loan for $360,000. So, in less than a year, buyers lost almost $200,000 of buying power.

Mortgage rates will be the key!

Do we know if interest rates, and thus mortgage rates, are going to continue to rise or will they fall? The answer to that lies in the inflation numbers. The Federal Reserve has stated that they want inflation at 2%. The understanding now is that the Federal Reserve is inclined to raise rates at least a few more times during 2023. If the Fed does raise rates, it will make money more expensive to borrow, meaning mortgage rates will likely rise.

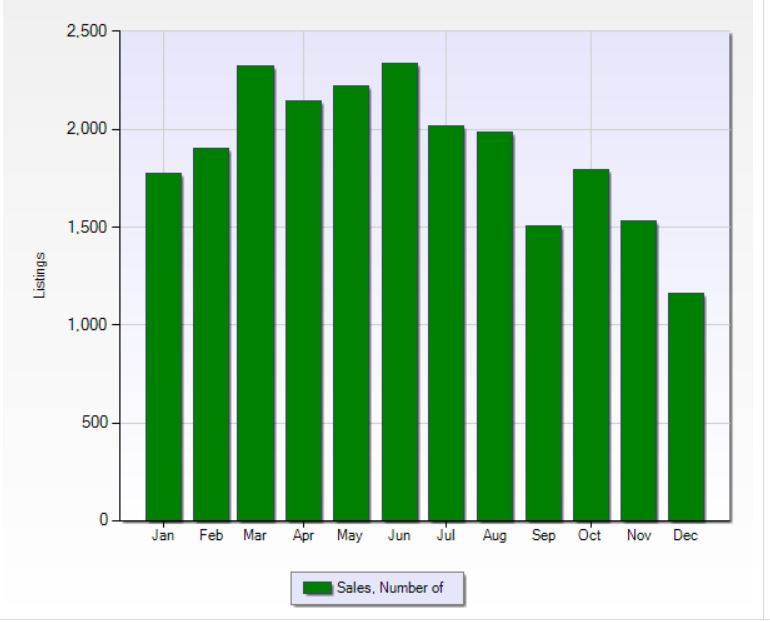

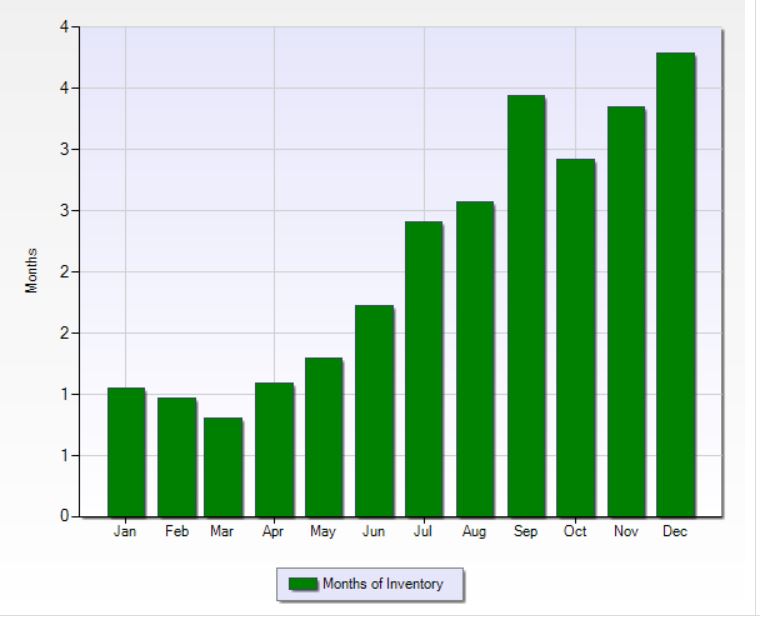

Looking at some charts from the 2022 real estate market, you can plainly see the impact the higher rates had in Hillsborough County.

Graphic 2 -Sales 2022 Graphic 3 – Days to Sell Graphi c 4 – Months of Inventory

Graphic 2 displays the number of sales over 2022. Graphic 3 displays the number of days to sell a home. Graphic 4 displays the months of inventory. These charts clearly show that the market has shifted.

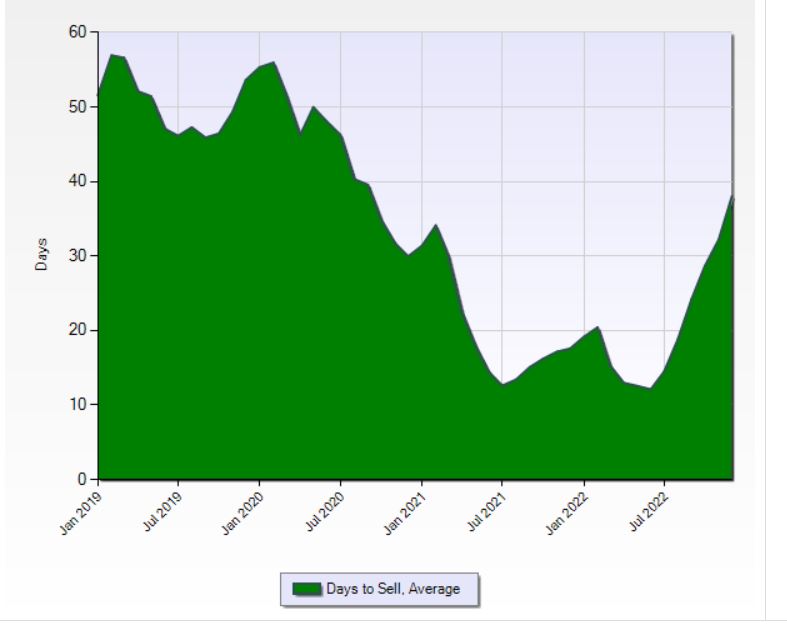

However, two more charts put the current numbers in perspective. These charts show the trend since January 2019.

Graphic 5 – Days to Sell since 2019

Graphic 5 gives a good overview of the days to sell since January 2019. Even though we saw an increase in days to sell to the end 2022, it is still fast compared 2019 and early 2020.

Graphic 6 – Active homes on the Market

Graphic 6 – Active homes on the Market

Graphic 6 displays the number of homes in Hillsborough County that are actively on the market. It is noticeable that during the COVID shutdown beginning in March 2020, the was a steep decline in the number of homes on the market.

This put the law of supply and demand to work. The low supply, coupled with the high demand caused home prices to rise quite drastically, as can be seen in Graphic 7 below.

Graphic 7 – Median Home Price in Hillsborough County since 2019

From July 2022 to November 2022, home prices in Hillsborough County dropped 4%. However, since January 2019, home prices have risen close to 70%.

Where do we go from here?

In 2023, we will continue to see a decline in median home prices mainly because sellers will have to lower their asking price to meet buyers’ affordability.

We will also see the days to sell and months of inventory continue to increase. However, we will also see fewer sellers listing their homes for sale which will damper the active listings and keep inventory low. All this is based on the assumption that mortgage rates will continue to rise.

If mortgage rates dip, you will see another buyer frenzy. Buyers are afraid that rates will rise and they will want to take advantage of the lower rate now.

In my next blog, in two weeks, I will address the question: Should I wait to buy a home?

For more information, you can contact me at JoeBrown@c21be.com

You can visit either of my websites to search for homes:

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link